On June 23, 2021, the U.S. Department of Labor (“U.S. DOL”) published a Notice of Proposed Rulemaking which would impose a limit on when an employer can pay a tipped worker the “tipped minimum wage.” The new rule would reinstate the “80/20” rule under federal law and would clarify that an employer may only take […]

On June 10, 2021, the Occupational Safety and Health Administration (“OSHA”) released an Emergency Temporary Standard (“ETS”) that outlines new requirements for healthcare settings. In addition, OSHA issued updated guidance for non-healthcare employers regarding protocols for mitigating the spread of COVID-19 among unvaccinated or at-risk employees in the workplace. We have summarized the pertinent portions […]

Governor Andrew M. Cuomo has announced that all COVID-19 restrictions are lifted immediately in New York State, as 70 percent of New Yorkers aged 18 or older have received the first dose of their COVID-19 vaccination. The State’s health guidance and New York Forward industry specific guidelines—including social gathering limits, capacity restrictions, social distancing, cleaning […]

The New York Health and Essential Rights Act (“HERO Act”) Amendments have been signed into law, which may come as welcome news to employers who might have been scrambling to understand and implement its requirements. As we previously reported, the HERO Act was enacted on May 5, 2021, mandating new workplace health and safety protections […]

The New York State Department of Labor (“NY DOL”) has recently issued guidance to all employers that any necessary recovery period from the COVID-19 vaccine is covered under the New York State Paid Sick Leave Law. Citing studies that found workers were avoiding the COVID-19 vaccine due to fear of missing a day of work due to […]

Earlier this year, the Occupational Safety and Health Administration (“OSHA”) issued guidance to clarify the recordability of employees suffering adverse side effects from a COVID-19 vaccination. That guidance provided that an adverse reaction to the COVID-19 vaccine is recordable if the reaction is: (1) work-related, (2) a new case, (3) meets one or more of […]

Get a sneak peak into our @work with ALG subscription service with this complimentary webinar. During it, you’ll learn about the newly enacted HERO Act, which requires New York employers to take certain steps to ensure a safe workplace. By June 4, 2021, employers must publish an “Airborne Infectious Disease Exposure Prevention Standard Policy.” The […]

In its most recently released guidance, the Centers for Disease Control and Prevention (“CDC”) has announced that individuals who are fully-vaccinated for COVID-19 are no longer required to wear a mask or practice social distancing in most indoor and outdoor settings. According to the CDC, this includes attending indoor gatherings, shopping, dining at restaurants, and […]

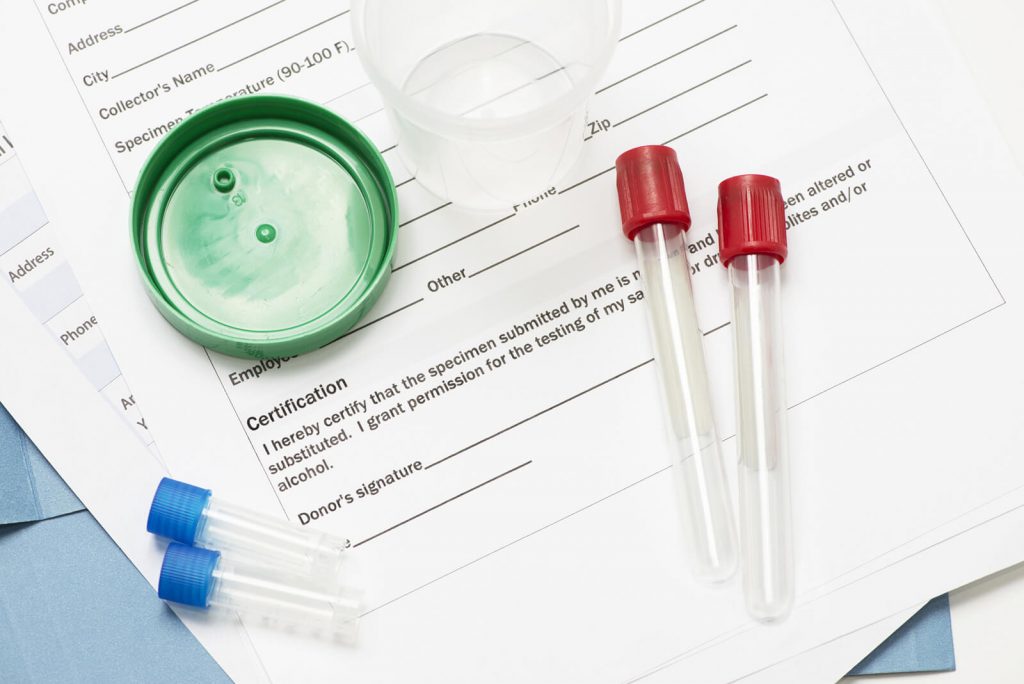

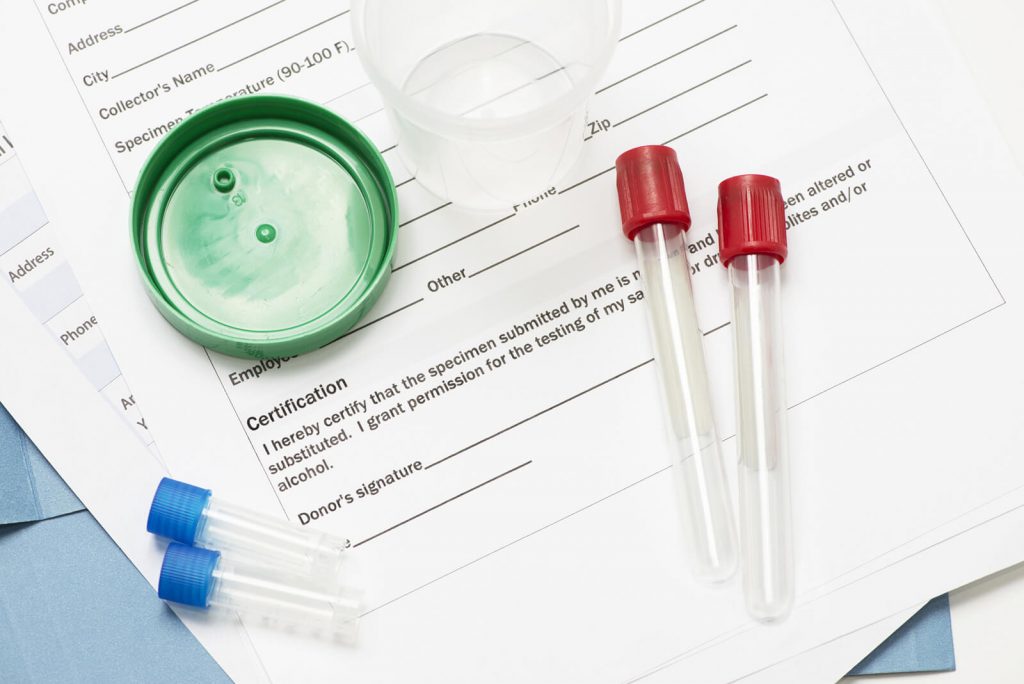

Employers have been grappling with confusing marijuana laws for years—and the rules are getting tougher to navigate as more states add employment protections. There are so many new developments with drug-testing and marijuana laws, it’s hard for employers to keep up. This webinar will cover what employers need to know about the changing landscape in […]

The U.S. Department of Labor (“DOL”) has announced a final rule officially withdrawing a proposed independent contractor rule that would have made it easier to classify workers as independent contractors under the Fair Labor Standards Act (“FLSA”). As we previously reported, the Trump administration proposed an independent contractor rule at the very end of his term. […]

Governor Andrew M. Cuomo announced that New York State will adopt the new guidance set forth by the Centers for Disease Control and Prevention (“CDC”) on mask use for fully vaccinated people. See ALG’s recent blog here. The guidance provides that fully vaccinated people no longer need to wear a mask outdoors, except in certain crowded settings […]

On Tuesday, April 27, 2021, the Centers for Disease Control and Prevention (“CDC”) released updated recommendations for fully vaccinated people. According to the guidance, fully vaccinated people no longer need to wear a mask outdoors, except in certain crowded settings and venues. Individuals are considered fully vaccinated for COVID-19 2 weeks after they have received […]